In finance and economics, it’s a useful concept that serves as a benchmark between conservative investors and risk seeking individuals. Risk averse investors avoid opportunities for growth because of their unwillingness to take risks. They limit their portfolios, resulting in fewer options for advancement and financial gain. With that said, risk aversion is a natural human tendency and it is not always bad. Income investing is another strategy that focuses on holding bonds and other fixed-income securities that generate regular cash flows, as opposed to seeking capital gains. Investment income is especially useful for retirees who no longer have employment income and cannot afford to experience losses in the markets.

This article explains how loss aversion works, presents an analysis of just how much value manager attitudes toward investment risk leave on the table, and offers suggestions for changes in practices and systems. While they are willing to engage in volatile markets to some extent, their investments in such markets are relatively small and controlled. Imagine three friends, Hugo, Sarah, and Michael, who are considering investing in a new technology startup. The startup has the potential to generate high returns, but also has a significant risk of failing completely. What he’s not willing to do is invest in a high-risk opportunity with a potential return lower than the risk-free rate.

… or search for risk-averse inside other dictionary definitions.

Why are managers in large, hierarchical organizations so risk-averse? CEOs are evaluated on their long-term performance, but managers at lower levels essentially bet their careers on every decision they make—even if outcomes are negligible to the corporation as a whole. Investors who exhibit a non-risk aversion towards risk understand that while there may be short-term losses, the long-term gains have the potential to outweigh them. They maintain a perspective that focuses on achieving favorable returns over the long run, recognizing that some level of risk is necessary to achieve their investment goals.

Economists and psychologists have long been aware that decision makers tend to place greater weight on the economic losses that could result from their decisions than on the potential equivalent gains. In 1979, Daniel Kahneman (a coauthor of this article) and the late Amos Tversky brought that concept to the forefront of management practice. (Their pioneering work in behavioral economics won Kahneman the 2002 Nobel Prize for economics.) Scores of empirical studies and experiments have further demonstrated the prevalence of loss aversion and identified its key features. Understanding the concept of risk tolerance and its role as the opposite of risk aversion is crucial for investors seeking to navigate the complex world of finance. Not being averse to risk means having a level of risk tolerance where you are willing to accept and manage risks, even if you do not actively seek them out.

Limitations of expected utility treatment of risk aversion

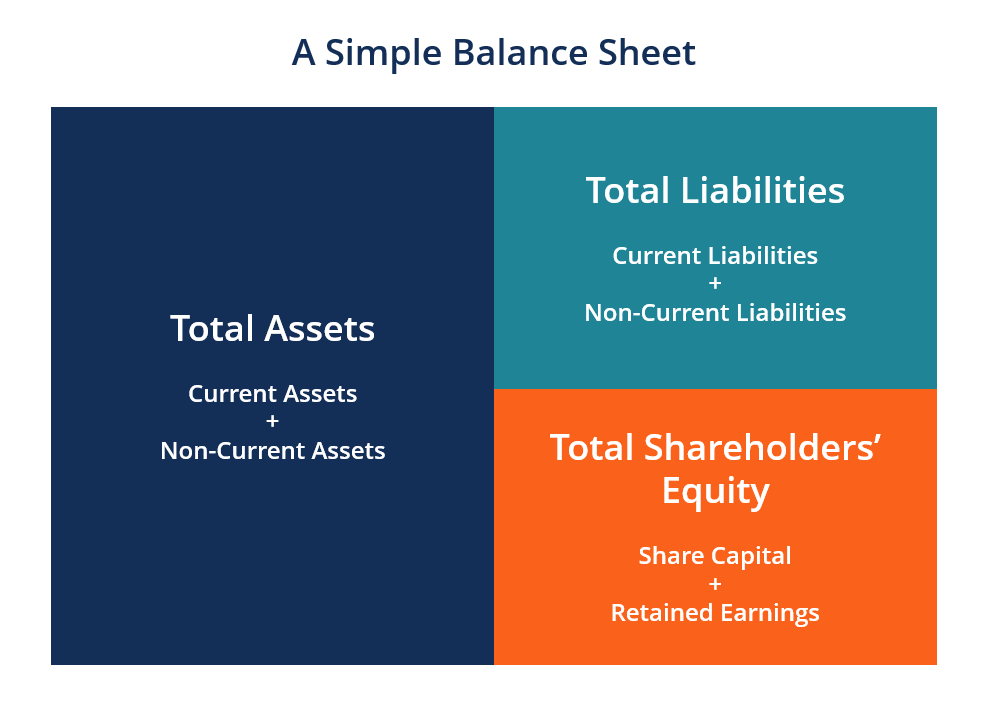

PV/I is a common return measure that will be familiar to most managers, regardless of the business unit they belong to. Let’s assume a company has five business units, each with 10 projects needing investment, for a total of 50 projects. Each unit proposes its 10 projects, presenting a careful risk assessment and a range of possible outcomes.

On the bright side, companies offering risk aversion also rarely fold up. Fortunately, Industry SuperFunds charge low fees, so that even in negative return years, losses are kept to a minimum. Opposite Of Risk averse, Antonyms of Risk averse, Meaning and Example Sentences! Opposite words or antonyms are a very important part of English vocabulary. English vocabulary consists of a lot of other useful terms, like synonyms, homonyms, similar words, and much more.

Little cause for optimism that Blinken’s China visit changed cyber equation

Let’s assume that the right level of risk for a company is the CEO’s risk preference. The difference in value between the choices the CEO would favor and those that managers actually make is a hidden tax on the company; we call it the risk aversion tax, or RAT. Companies can easily estimate their RAT by conducting a survey, like Thaler’s, of the risk tolerance of the CEO and of managers at various levels and units. Factors affecting risk tolerance levels include age, financial situation, and investment horizon.

“Today’s market pivots from a funeral to a party as fast as a VFW hall.” – Sports News Now 24

“Today’s market pivots from a funeral to a party as fast as a VFW hall.”.

Posted: Sat, 17 Jun 2023 18:45:00 GMT [source]

If your portfolio comes off as one with enhanced stability and security, it means you adopt a less risk-tolerant approach. They are more interested in a safe and steady inflow of returns on every bond, bond fund, and ETF investment. Moderate risk-taking investors also engage in volatile markets, however, their investments in such markets are always negligible. In other words, a risk-tolerant investor is someone with a long-term view of making a higher profit even if their capital suffers a few losses along the way.

Age of the investor

It is often useful to have a number of executives assign probabilities, particularly those not advocating for the project. They will have less at stake, may be more objective, and may have a broader set of experiences. When many executives assign probabilities, the range of outcomes tends to be more extreme, which can help trigger useful discussions. And of course, the project champion should not be responsible for deciding which probability is accurate—that is a recipe for disaster. Most managers in large organizations are significantly more risk-averse than CEOs, who consider each investment in the context of a greater portfolio.

- Instead, they prioritize stability and aim to keep their investments in a safe zone, regardless of how the market moves.

- It is not unlikely, therefore, that if it were to allow a greater probability of failure for its investments, few or none of its decisions in a given time period would end in a successful outcome.

- CEOs are evaluated on their long-term performance, but managers at lower levels essentially bet their careers on every decision they make—even if outcomes are negligible to the corporation as a whole.

- Others, despite an orthographic similarity (such as allusion and illusion), have markedly different meanings.

In advanced portfolio theory, different kinds of risk are taken into consideration. In finance and superannuation, the meaning of risk aversion relates to a person’s approach to investing. People who choose more stable investments, even if that means getting lower returns, are said to be risk averse. This is certainly not a negative though, and for some people, being risk averse can be a smart move.

Von Neumann-Morgenstern utility theorem

They have a low tolerance for risk and prefer investments that offer a safe and steady inflow of returns. Investors with aggressive risk-taking attitudes constantly seek opportunities to capitalize on market movements and risk averse opposite fluctuations, often engaging in short-term trading or active portfolio management. Aggressive investors are characterized by their high-risk tolerance level and desire for substantial returns within a short period.

- It’s all about the expected return and the risk-free interest rate, regardless of the risk involved.

- Investors who are risk tolerant take the view that long-term gains will outweigh any short-term losses.

- On the one hand, you greatly lower your chances of losses, but you also can miss good opportunities and greater returns on riskier investments.

- Because they are conservative, they tend to pay relatively low rates of interest to investors.

The investment horizon or time is how much time an investor is willing for his investments to roll. As a risk-tolerant investor, if you plan to allow your investment to play out over a few years, you can employ a high-risk-tolerant approach. When you see a conservative investor’s portfolio, all you will notice is slow and steady growth with maximum protection and low risks. Conservative investors avoid risky assets like equities and instruments with a high degree of uncertainty.

| Tutti i diritti riservati 2022 © AS P.r.i

| Tutti i diritti riservati 2022 © AS P.r.i